|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top Online Refinance Lenders: A Comprehensive Guide for HomeownersRefinancing your mortgage can be a smart financial move, especially with the right lender. In this guide, we'll explore some of the top online refinance lenders, their benefits, and how to choose the best option for your needs. Understanding Mortgage RefinancingMortgage refinancing involves replacing your existing home loan with a new one. This can help you secure a lower interest rate, reduce monthly payments, or even access home equity for other financial goals. Benefits of Online Refinance LendersOnline refinance lenders offer several advantages over traditional brick-and-mortar banks.

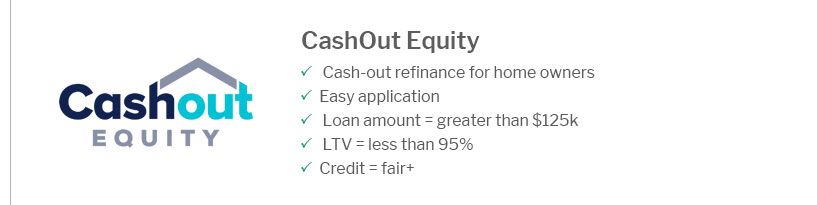

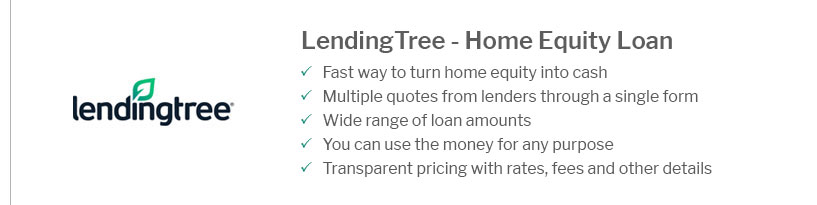

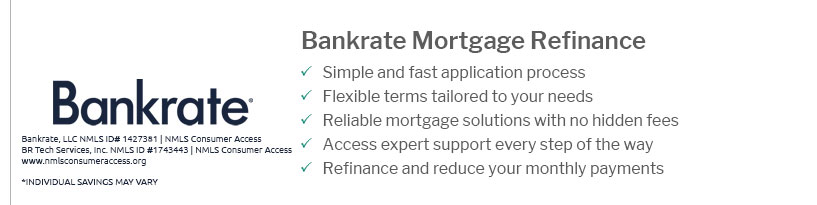

Top Online Refinance Lenders1. Lender ALender A is known for its user-friendly platform and competitive rates. With a simple online application process, you can quickly find out if you qualify for refinancing. 2. Lender BLender B offers a variety of refinancing options, including the ability to refinance mortgage with cash out option, making it a versatile choice for homeowners looking to tap into their home equity. 3. Lender CRenowned for exceptional customer service, Lender C provides personalized assistance to ensure you understand your refinancing options. Choosing the Right LenderWhen selecting a refinance lender, consider factors such as interest rates, fees, and customer service. It's also important to evaluate whether the lender offers specific options that suit your financial situation, such as the ability to refinance mortgage with bankruptcy considerations. Frequently Asked Questions

ConclusionChoosing the right online refinance lender can save you money and simplify the refinancing process. Evaluate your options, consider your financial goals, and select a lender that meets your needs. With the right choice, refinancing can be a beneficial step towards a healthier financial future. https://www.lendingtree.com/home/mortgage/what-is-an-online-mortgage/

Best Online Mortgage Lenders of 2025 - Summary: Best online mortgage lenders - Best online lender for jumbo loans: Ally Bank - Best online lender for FHA loans: ... https://www.reddit.com/r/RealEstate/comments/10znj6m/best_online_mortgage_lender/

Total noob trying to purchase my first home here. According to fund.com and bestonlinemortgageloan.com , Rocket Mortgage and Quicken Loans ... https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

The Yahoo view: Truist earns top honors for refinancing because of its broad selection of loans, no doubt contributing to its standing as a top ...

|

|---|